Financial Happenings Blog

Tuesday, March 06 2012

The latest SPIVA Scorecard (Standard & Poors Indices Versus Active funds) has been released and even though there has been some slight improvement for active fund managers since the last report, the overall news remains bleak.

The key findings were:

· The S&P/ASX 200 Accumulation Index has outperformed at least 60% of active Australian equity funds over the periods of one year or more. The S&P/ASX 200 Accumulation Index has outperformed approximately 63% of active Australian Equity General funds over the last five years.

· Active Australian Equity Small-Cap funds have significantly outperformed the benchmark across all periods studied in this report. Over the last five years approximately 80% of active Australian Equity Small-Cap funds have outperformed the S&P/ASX Small Ordinaries Index, with this majority increasing to 90% over the last year. Both the equal- and asset-weighted average returns of the active fund category have far outperformed the S&P/ASX Small Ordinaries Index across all periods studied.

· With the exception of active Australian Equity Small-Cap funds, a majority of funds across all categories have failed to beat their respective indices over all periods observed in this report. Over the last year at least two-thirds of active funds across most categories failed to beat their respective indices. Australian Equity Small-Cap funds are the only exception to this finding.

· At least 80% of active International Equity General funds underperformed relative to the benchmark over the last year. Over both three- and five-year periods, at least 62% of International Equities General funds have failed to beat the index.

· Over the last five years approximately 84% of active Australian Bond funds have failed to beat the index. However, over three years the underperforming percentage falls to approximately 62%.

· Approximately 57% of active Australian A-REIT funds have failed to beat the benchmark over the last five years, increasing to an even larger majority of 74% when taking into account only the last year. Over both three- and five-year periods, active Australian Equity A-REIT funds enjoyed the highest survivorship rate when compared to the other active categories covered in the SPIVA Australia Scorecard.

The only bright spot to mention for active managers is in relation to small caps. A major reason for the out-performance is that many small cap managers will dig a lot deeper than the S&P index which stops at the 500th largest company on the ASX. The manager we use for small caps uses an index style approach but invests in much smaller companies than just those in the ASX500. This fund has also significantly out-performed the S&P index by 2.11% through 2011, 3.47% p.a.over 3 years and 4.79% p.a. over 5 years.

Concluding Comments

This research again backs up our firm’s approach to build a portfolio around index style funds which promise lower fees and better than average performance compared to their actively managed counterparts.

Click on the following link for a copy of the full SPIVA report.

Regards,

Scott

Thursday, January 12 2012

Jim Parker, of Dimensional Australia, in his latest Outside the Flags column points out some of the reasons why this firmdoes not include hedge funds in our investment approach. It gets back to two key fundamentals:

- Understand into what you are investing

- Keep costs low

We don't belive hedge funds provide either of these outcomes. Please find Jim's comments following.

Regards,

Scott

It's true. Big money can be made from hedge funds. If you run one, that is.

That's the conclusion of a new book, which says people who invest in hedge funds would have been better off over the past nine years if they had stuck to a broadly diversified portfolio of vanilla stocks and bonds.

The book is called 'The Hedge Fund Mirage: The Illusion of Big Money and Why It's Too Good to be True'. It was written by Simon Lack, an asset manager who formerly chose hedge funds for major US bank JPMorgan.

Lack argues that the 18 per cent return on hedge funds in the nine years to November, 2011 was easily beaten by the total 29 per cent gain from the S&P-500 index. The gap was even starker for investment grade corporate bonds, which in the same period gained 77 per cent, as measured by the Dow Jones Corporate bond index.

Of course, the underperformance of hedge funds over this period is even greater once the customary 2 per cent management fee and 20 per cent performance fees charged by hedge fund managers are taken into account.

If individual hedge fund managers are generating the desired "alpha", or additional returns above the market, then the benefits of that skill tend to go to the managers themselves than to investors.

In fact, Lack estimates that from 1998 to 2010, the hedge fund industry captured at least 86 per cent of the returns it earned for its customers. This might explain why yachts cruising the Caribbean tend to be skippered by hedge fund managers, not investors.

For anyone who has followed the hype surrounding hedge funds for many years, this is not really a surprise. A good proportion of the investing public–egged on by the financial media–genuinely wants to believe that consistent market-beating returns are achievable without taking on additional risk and paying excessive fees.

From a marketing perspective, at least, the appeal is fairly evident. After all, the more exclusive you make a club, the more likely people will pay a premium for joining it.

While the hedge fund industry no doubt would contest the findings of Lack's book, one doesn't have to agree with his numbers to still harbour reasonable doubts about risking one's hard-earned savings by investing in hedge funds.

In a recent white paper1, Dimensional research associate Ronnie Shah explains that due to the lack of disclosure around returns, it is difficult to determine how much alpha, if any, hedge funds generate.

Industry groups that report hedge fund returns rely on voluntary disclosures by the funds themselves on the returns they generate. Shah notes this creates potential for biases in the data, such as the omission of poor returns or the dropping out of the returns of failed or discontinued funds.

This is in addition to other drawbacks of hedge funds, such as illiquidity, relative lack of oversight, the additional costs of leverage and derivatives and, of course, the substantial fees charged by the managers themselves.

Shah's paper concludes that the highly uncertain payoff from hedge funds, the high expense ratios and the lack of disclosure around them mean investors should exercise caution before investing in them.

Starting one up is another matter altogether.

Wednesday, January 11 2012

More and more Australians are seeking out independent financial advice. The key reason for doing so is to have some level of comfort that the advice that is being received is actually given to benefit you rather than your adviser (and his or her backer).

Unfortunately it seems that it consumers find it difficult to actually determine the independence of the adviser. The latest Roy Morgan Research - Superannuation and Wealth Management in Australia - points out that many consumers even though they know a firm is owned by a major financial institution, such as the big four banks and AMP, believe that the advice they will receive is independent of any bias.

The report goes on to show that this is not the case with the following key findings:

- 70% of products recommended by advisers working for an institutionally-owned licensee were provided by the parent company.

- AMP planners were the most likely to recommend their own products, with 78.9% of their members directed into AMP managed products, followed by CBA/Colonial at 76.3% (in the 12 months to June 2011).

- At the opposite end of the spectrum, only 41.5% of ANZ/OnePath advised customers were sold the group's products.

- It was recognised in the report that these products may contain some funds managed externally.

For me, if you go to an adviser with links to a major financial institution, and 70% of the products recommended to you on average are products that are provided by the financial institution some alarm bells must be going off as to the independence of the advice.

The advice may be sound and the products recommended might just be the very best for you in your situation but some doubt must linger. It is important to be going in to discussions with your eyes wide open and ask the tough questions.

So what big questions should you be asking?

1) Is the firm owned by another major institution?

2) Are there extra financial or promotion incentives for the adviser to recommend products from that financial institution?

3) Is the adviser limited to using certain products and if so why?

4) What is the underlying investment philosophy on which the product choices have been made?

A Clear Direction openly encourages consumers to find financial advice that is independent of what we refer to as "ownership bias". If you want to find out more please get in contact.

Regards,

Scott

Monday, January 09 2012

A common perception over recent years is that diversification no longer serves an investor well. Seemingly markets rise and fall in lock step as do the underlying companies.

2011 provided us with a reminder that markets and indeed companies are not as correlated as we might think. The US was one of the strongest markets all be it just getting into positive territory when factoring in dividends - S&P500 2.1%. Whereas the ASX200 had a relatively poor year falling 10.5% after including dividends.

(NB - If we take into account currency movements the S&P500 in Australian dollar terms did not do quite as well but still better than the ASX500.)

Within the top 25 Australian companies (by market capitalisation) there were quite varying returns over the past 12 months. The Morningstar site this morning shows that Telstra has been the standout with a return of over 30%. Whilst at the other end Fortescue has been weak falling just under 30%. Who would have thought this 12 months a go??

Weston Wellington from Dimensional Fund Advisors in the US, digs a ittle deeper into the data to show that there were also big differences between company returns over ethere.

The clear message is that the benefits to be gained from diversification are not dead.

Weston's article follows. Well worth a read.

Equity investors around the world had a disappointing year in 2011 as thirty-seven out of forty-five markets tracked by MSCI posted negative returns. The US did well on a relative basis and was the only major market to achieve a positive total return, although the margin of victory was slim. Total return for the S&P 500 Index was 2.11%, and the positive result was a function of reinvested dividends—the index itself finished the year slightly below where it started.

Throughout the year, investors seeking clues regarding the strength of business conditions or the prospects for stock prices were confronted with ample reason to rejoice or despair. Optimists could cite the strong recovery in corporate profits and dividends, the substantial levels of cash on corporate balance sheets, low interest rates and inflation, a booming domestic energy sector, continuing strength in auto sales, and record-high share prices for leading multinationals such as Apple, IBM, and McDonald's. Pessimists could point to persistently high unemployment, slumping home prices, tepid growth in retail sales, worrisome levels of government debt at home and abroad, and political gridlock in both Congress and various state legislatures.

Although the broad market indices showed little change for the year, there were opportunities to make a bundle—or lose one. Among the thirty constituents of the Dow Jones Industrial Average, thirteen had double-digit total returns, including McDonald's (34.0%), Pfizer (28.6%), and IBM (27.3%). But losing money was just as easy: The three worst performers in the Dow were Hewlett-Packard (–37.8%), Alcoa (–43.0%), and Bank of America (–58.0%). If nothing else, the substantial spread between these winners and losers discredits the argument we often hear that all stocks are now marching in lockstep and that diversification is ineffective.

Achieving even modest results in the US market required more discipline than many investors could muster, since investor sentiment fluctuated dramatically throughout the year and the temptation to enhance returns through judicious market timing often proved irresistible.

For fans of the "January Indicator," the year got off to a promising start as stock prices jumped higher on the first trading day, pushing the Dow Jones Industrial Average to a twenty-eight-month high. Bank of America shares jumped 6.4% that day, the top performer among Dow constituents. With copper prices setting new records and factory activity worldwide perking up, the biggest worry for some was the potential for rising prices and higher interest rates that might choke off the recovery. "Overheating is the biggest worry," one chief investment strategist observed. By April 30, the S&P 500 was up 8.4%, reaching a new high for the year.

Stocks wobbled through May and June but strengthened again in July. On July 19, the Dow Jones Industrial Average had its sharpest one-day increase of the year, jumping over 200 points, paced by strong performance in technology stocks. Just a few days later, however, stocks began a precipitous decline that took the S&P 500 down nearly 17% in just eleven trading sessions. The century-old Dow Theory—a sentimental favorite among market timers—flashed a "sell" signal on August 3, and on August 5, Standard & Poor's downgraded US government debt from AAA to AA+. As investors sought to assess the implications of sovereign debt problems in both the US and Europe, stock prices fluctuated dramatically, with the S&P 500 rising or falling over 4% on five out of six consecutive trading days in early August. Rattled by the sharp day-to-day price swings, many investors sought the relative safety of US Treasury obligations in spite of the rating downgrade, pushing the yield on ten-year Treasury notes to a record low. Stock prices hit bottom for the year on October 3 as some market participants apparently lost all confidence in equity investing. A Wall Street Journal article cited a number of individual investors as well as professional advisors who had recently sold all their stocks and did not expect to repurchase them anytime soon. "I feel like a deer in the headlights," said one.

As it turned out, the article appeared in print on the second day of a powerful rally that sent the Dow Industrial Average surging over 1,500 points during the next 19 trading days, putting it back into positive territory for the year.

What can we learn from a difficult year like 2011? As Dimensional founder David Booth is fond of saying, the most important thing about an investment philosophy is that you have one. Many investors (as well as some professional advisors) apparently decided to switch from a buy-and-hold philosophy to a market timing strategy in the midst of an unusually stressful period in the financial markets. We suspect few of those adopting the change would have been able to clearly articulate their investing beliefs and why they had shifted.

Legendary investor Benjamin Graham offered the following observation nearly forty years ago: "There is no basis either in logic or in experience for assuming that any typical or average investor can anticipate market movements more successfully than the general public, of which he himself is a part."

Good advice then, good advice now.

Mark Gongloff, "Investors' Forecast: Sunny With a Chance of Overheating," Wall Street Journal, January 3, 2011.

Jonathan Cheng and Sara Murray, "Stock Surge Rings in Year," Wall Street Journal, January 4, 2011.

Matt Phillips and E.S. Browning, "Tech Sends Stocks Soaring," Wall Street Journal, July 20, 2011.

Steven Russsolillo, "'Dow Theory' Confirms It's an Official Swoon," Wall Street Journal, August 4, 2011.

Damian Paletta, "U.S. Loses Triple-A Credit Rating," Wall Street Journal, August 6, 2011.

Tom Petruno, "Investors Stampede to Safety," Los Angeles Times, August 19, 2011.

Kelly Greene and Joe Light, "Tired of Ups and Downs, Investors Say 'Let Me Out'," Wall Street Journal, October 5, 2011.

Benjamin Graham, The Intelligent Investor (New York: HarperCollins 1949).

The S&P data are provided by Standard & Poor's Index Services Group.

MSCI data copyright MSCI 2011, all rights reserved.

Yahoo! Finance, www.yahoo.com, accessed January 3, 2012.

Tuesday, November 15 2011

The latest edition of the ASFA Retirement Standard has been published today - ASFA Retirement Standard September 2011. The details show that the costs of living for singles and couple in retirement continue to rise.

The key annual figures are:

Modest lifestyle for a single - $21,957

Comfortable lifestyle for a single - $31,767

Modest lifestyle for a couple - $40,412

Comfortable lifestyle for a couple - $55,316

These figures show that the rate of inflation over the 12 months to the end of September has been between 2.82% (Modest lifestyle for a couple) and 3.96% (Comfortable lifestyle for a single).

These figures provide a useful guide for those preparing for retirement both in terms of absolute income requirements but also the rate of inflation being experienced by retirees.

I don't think that it comes as any surprise that the cost of living for those in retirement tends to be growing at a faster rate than the Australian Bureau of Statistics inflation gauge - the Consumer Price Index. Over recent periods this gauge has shown that the costs of food and energy (something that retirees spend a large percentage of their income paying) are rising whereas the costs of buying electronics and cars (things that retirees don't tend to spend a lot on) are not rising as much or even falling.

The other potential use of the quarterly report is to provide a budgeting tool to compare your spending against that of the report contained in the Budget Breakdowns.

Well worth a look for those planning for or in the retirement phase of life!!

Regards,

Scott

Friday, September 30 2011

It has been a number of months since we last updated the site with Scott Francis; Eureka Report articles. Today we have uploaded the following viewpoints:

30/09/2011 - Let's fix investor OH&S - There are four ways markets are stacked against retail investors. Here's what should be done.

24/08/2011 - Tread carefully with this hybrid - Rather than lending to the ANZ for eight years, perhaps you should just buy its shares.

12/08/2011 - Dividend power - Higher yield on sold down stocks could help investors protect themselves against short-term capital losses.

25/07/2011 - How does zero tax sound? - Inside or outside of superannuation, here's a handy tax break.

15/07/2011 - Clean up with carbon tax - Get ready to make the most of the new tax scales from July next year.

11/07/2011 - Eight reasons to invest outside super - It's a great place to accumulate wealth, but super is only one part of a sound investment strategy.

29/06/2011 - My simple market beater - Easy, proven investment strategies once again outperform the clever manoeuvres of sophisticated investors.

15/06/2011 - Divide and Conquer - Splitting superannuation contributions could be making a comeback with looming rule changes

Wednesday, August 31 2011

The following article was prepared by Jim Parker, Vice President Dimensional Fund Advisors Australia. In it Jim presents seven key considerations for us all to be considering. Thanks Jim!!

The current renewed volatility in financial markets is reviving unwelcome feelings among many investors—feelings of anxiety, fear and a sense of powerlessness. These are completely natural responses. Acting on those emotions, though, can end up doing us more harm than good.

At base, the increase in market volatility is an expression of uncertainty. The sovereign debt strains in the US and Europe, together with renewed worries over financial institutions and fears of another recession, are leading market participants to apply a higher discount to risky assets.

So developed world equities, oil and industrial commodities, emerging markets and commodity-related currencies like the Australian dollar are weakening as risk aversion drives investors to the perceived safe havens of government bonds, gold and Swiss francs.

It is all reminiscent of the events of 2008 when the collapse of Lehman Brothers and the sub-prime mortgage crisis triggered a global market correction. This time, however, the focus of concern has turned from private sector to public sector balance sheets.

As to what happens next, no-one knows for sure. That is the nature of risk. But there are seven simple lessons that individual investors can keep in mind to make living with this volatility more bearable.

1. Don't make presumptions.

Remember that markets are unpredictable and do not always react the way the experts predict they will. The recent downgrade by Standard & Poor's of the US government's credit rating, following protracted and painful negotiations on extending its debt ceiling, actually led to a rise in the prices of US Treasury bonds.

2. Someone is buying.

Quitting the equity market at a time like this is like running away from a sale. While prices have been discounted to reflect higher risk, that's another way of saying expected returns are higher. And while the media headlines proclaim that "investors are dumping stocks", remember someone is buying them. Those people are often the long-term investors.

3. Market timing is hard.

Recoveries can come just as quickly and just as violently as the prior correction. For instance, in March 2009—when market sentiment was last this bad—the US S&P-500 turned and put in seven consecutive of months of gains totalling almost 80 per cent. This is not to predict that a similarly vertically shaped recovery is on the cards this time, but it is a reminder of the dangers for long-term investors of turning paper losses into real ones and paying for the risk without waiting around for the recovery.

4. Never forget the power of diversification.

While equity markets have had a rocky time in 2011, fixed income markets have flourished, making the overall losses to balanced fund investors a little more bearable. Diversification spreads risk and can lessen the bumps in the road.

5. Markets and economies are different things.

The world economy is forever changing and new forces are replacing old ones. As the IMF noted recently1, while advanced economies seek to repair public and financial sheets, emerging market economies are thriving. A globally diversified portfolio takes account of these shifts.

6. Nothing lasts forever.

Just as smart investors temper their enthusiasm in booms, they keep a reserve of optimism during busts. And just as loading up on risk when prices are high can leave you exposed to a correction, dumping risk altogether when prices are low means you can miss the turn when it comes. As always in life, moderation is a good policy.

7. Discipline is rewarded.

The market volatility is worrisome, no doubt. The feelings being generated are completely understandable. But through discipline, diversification and understanding how markets work, the ride can be made bearable. At some point, value will re-emerge, risk appetites will re-awaken and for those who acknowledged their emotions without acting on them, relief will replace anxiety.

Sunday, May 29 2011

An important consideration when determining your optimal asset allocation mix is to consider the potential risks and rewards to be realised from various asset classes.

The events of 2008 clearly remind us of the risks involved with investing in volatile asset classes such as shares but what should we expect to achieve from these investments?

Each year Credit Suisse publishes their Global Investment Returns Yearbook which looks at historical returns for major markets. The 2011 yearbook which includes data up to the end of 2010 provides some very useful insights.

Over the 111 years of data available to the authors,

- Equity returns have beaten inflation, treasury bills (short duration government debt) and bonds in all 19 countries included in the study.

- Australia has been the best performing equity market with a real return of 7.4%.

- The equity risk premium in Australia has been 6.7% over risk-free treasury bills.

- The equity risk premium in Australia has been 5.9% over bonds.

- The volatility experienced in Australian shares has been slightly higher than the global average.

- A globally diversified portfolio of equities has provided a real return of 4.5% over Treasury bills and 3.8% over bonds

On top of this pure statistical analysis, the authors of the report – Dimson, Marsh, Staunton, Holland & Matthews provide analysis of two key investment issues:

- Whether we are experiencing a bond market bubble and the implications for investors?

- Whether chasing higher yielding share investments provides a better outcome over the long term?

The analysis contained in the report suggests that over the past 30 years, and especially the last 10 years, there have been strong returns from investing in bonds on a par with or better than equity returns across the globe. (Australian shares have out-performed Australian bonds over that period.) Over the long term bonds have provided less returns with less volatility which suggests the returns from the past decade have been abnormal. The authors therefore suggest that the strong performance from bonds should not persist especially within a low interest rate period with higher inflation expectations.

In terms of high yielding shares, the research clearly suggests there is a premium to be earned from investing in this style of shares over the long term as reflected in the long term historical data. Over short time periods higher yielding shares may under-perform so it is not a free lunch.

Conclusions

So what can we take away from these findings?

I believe that the report reconfirms a number of the approaches to investment applied in client portfolios:

- If you can afford a long timeframe for your investments (preferably forever) than share investments do provide a significant premium over inflation, cash and bonds and should form a significant part of a portfolio.

- It has been prudent to have an over-weight exposure to Australian shares being conscious that this may provide a slightly higher level of volatility.

- Bonds have had a great recent performance history but this is unlikely to continue forever. However we should not expect to see huge falls in bond prices especially at the lower maturity, higher quality part of the market.

- Bonds have provided a slight premium over more liquid defensive assets and therefore are a valid use as a part of an asset allocation to reduce volatility but provide a slightly higher return than investing in cash.

- Incorporating a higher yield / value strategy into asset allocations is a valid approach to lift expected returns.

Please take a look at our Building Portfolios page for further details of our approach.

Regards,

Scott

Friday, May 27 2011

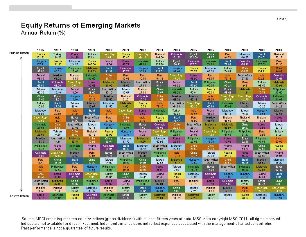

The final in a series of charts that have been uploaded to the site in recent days looks at 15 years of return history for 21 emerging markets up until the end of 2010.

The first page of the chart ranks the returns from each market year by year.

The second page breaks the chart down in alphabetical rather than year by year rank order.

An interesting take away was the under-performance of the BRIC markets - Brazil, Russia, India and China in 2010 and 2008. It is also interesting to see the huge swings in fortunes for markets from one year to the next.

It reminds us of the great difficulty in picking the best market in which to be invested in for the long term and also the risks involved with trying to pick "winning" emerging markets from one year to the next. We think holding a portfolio invested in all of these markets makes better sense.

Click on the image to view a full page printable pdf copy

Adobe Reader® required Adobe Reader® required

download at Adobe.com

Friday, May 27 2011

Today we have emailed out the latest edition of our free email newsletter to subscribers. In this edition we:

- discuss possible end of financial year strategies,

- look at two great charts depicting world market capitalisations and developed market equity returns year by year over the past 25 years,

- update major investment market performance,

- take a look at the schemes that fail investors more than others,

- outline recent blog entries,

- look at an article from the archive - 10 costly tax mistakes,

- outline recently published Eureka Report articles,

- provide a link to ASIC's new financial guidance website - Money Smart, and

- provide updated evidence of the three factor model in action.

Please note that there was a missing link for the developed market equity returns year by year over the past 25 years. The link is here.

To view a copy of the newsletter please click on the following link - Clear Directions May Edition

To sign up to receive the newsletter directly into your inbox follow this link - Sign up for Clear Directions

|

|

|

|